17 May Your Guide To Trusts

Your Guide to Trusts

What are the new rules relating to Family Trusts?

The Trusts Act 2019, which came into force on 30 January 2021, is the first major Trust law reform in New Zealand in 70 years. Many of the key changes are aimed at making Trust law more accessible to lawyers, accountants, and the public, strengthening the ability of beneficiaries to hold Trustees to account. The Act codifies many duties and responsibilities which had arisen through case law.

The main provisions of the Act provide clarity about:

- Mandatory Trustee duties – these can’t be modified by the Trust Deed

- Default Trustee duties – these can be modified or excluded by the terms of the Trust

- Retention of information – Trustees are required to retain core Trust documents necessary for the administration of the Trust

- Disclosure of information – there is a presumption that the Trustee must make basic Trust information available to all beneficiaries and other Trust information available to beneficiaries who request it; however, the Trustee may withhold the information in some circumstances

- Exemption and indemnity clauses – Trust Deeds must not limit a Trustee’s liability or provide an indemnity for dishonesty, wilful misconduct or gross negligence

- Appointment and removal of Trustees – Statutory powers for appointment and removal of Trustees have been modernised and broadened to minimise the need to apply to the court

- Lifetime of a Trust – Trusts can now have a lifetime of up to 125 years, subject to the powers in the Trust Deed

- Definition of a minor – the age of minority has been reduced from 20 to 18 years old

- Disputes resolution – an alternative disputes resolution process is set out in the Act

What is a Trust?

A Trust is a legal relationship in which a person (the Trustee) holds an interest in property for the benefit of another person(s) or for a specified object or purpose (the Beneficiary(ies)).

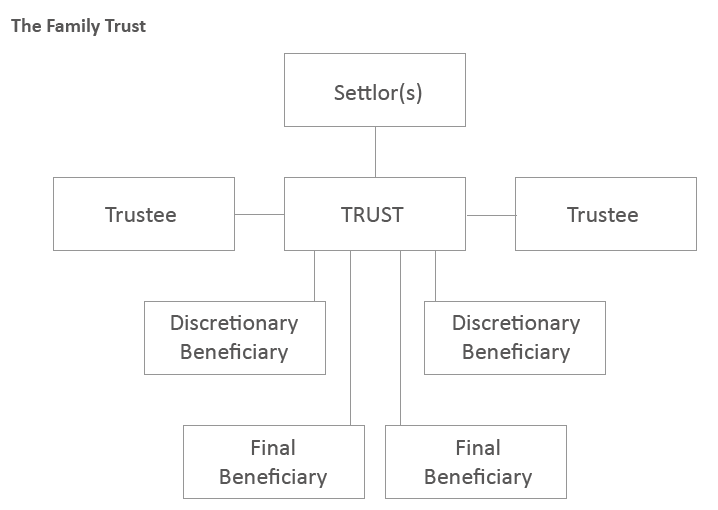

There are three categories of persons involved in a Trust relationship:

The Settlors – The people who create the Trust by transferring property into the Trust (initially or at a later stage).

The Trustees – The people who are responsible for the management of the Trust. Their names will appear on the documents of title or ownership of some assets held within the Trust.

The Beneficiaries – The people who benefit from the Trust relationship, either by receiving income and/or capital during the term of the Trust (the beneficiaries) or upon final distribution of the Trust’s assets (the final beneficiaries).

Setting up a Family Trust can help protect your assets, as well as secure your children’s future…

The way some people put it, Trusts appear to be the answer to a lot of financial worries. So, is a Trust a good idea for you? The answer depends on your circumstances. Trusts are generally set up to protect assets and look after dependent people. They can have a valuable role to play, but they are not suitable for everyone.

Costs of forming a Trust

The costs of forming a Trust include the initial legal set up costs and ongoing annual administrative costs (usually in relation to annual gifting, a regular review of personal circumstances and any developments in Trust law and practice, as well as documenting any decisions made by the Trustees). A Trust may be issued with an IRD number and have to file a tax return (even nil returns). It may need to be GST registered in some situations.

Objectives of a Trust

There are a number of reasons to form a Family Trust and potential benefits that arise from doing so. These include:

Asset protection – Assets in a Trust can be protected from creditors in the event of personal bankruptcy or the insolvency of a company of which a person is a shareholder or director. However, the extent of this protection will depend on matters such as the donor’s solvency when gifts are made to a Trust and whether dispositions of property were made that have the effect of defeating a creditor’s interest.

Continuity – Trusts can continue to operate after the death of the Settlor without any immediate need to sell assets to distribute among beneficiaries. Progressive release of funds to beneficiaries can occur and distribution to vulnerable beneficiaries can be delayed until appropriate. Family heirlooms can also be protected. Trusts can operate for limited periods; many have a maximum life of 80 years, however, the Trusts Act 2019 allows this to be extended to 125 years, subject to the current powers and provisions within the Trust Deed.

Government claw-back or ‘surtax’ type taxation – Assets in a Trust can give protection when assessing future entitlement to residential care subsidies. However, as there are strict rules regarding means, income, and gifting, specialist advice is recommended if a residential care subsidy application is contemplated. Historically, Trusts have reduced the impact of additional personal taxation assessed against the elderly on an income / means testing basis such as the surcharge.

Death Duty or Wealth Tax – Assets in a Trust can give protection against Death Duties or Inheritance Taxes (Note: There are no Death Duties at present. However, these cannot ever be entirely discounted). If a Capital Gains or Capital Transfer Tax is introduced in the future, provided such tax is assessed on the profit made on any sale and the Trust does not dispose of property, such a tax could possibly be avoided.

Property (Relationships) Act – Whether property transferred to a Trust will be at risk in the event of a marriage, civil union or de facto break up will depend on individual circumstances and whether any disposition to a Trust has the effect of defeating a spouse or partner’s interests or expectations.

Family Protection Act – Assets in a Trust are generally safe from family protection claims by disgruntled family members who disagree with the provisions of a deceased person’s will.

Protection in old age – Trusts can be structured to reduce the risk that an elderly person will lose family assets through an unwise marriage late in life and a subsequent matrimonial settlement. They can also protect against the undue influence of other family members or poor financial decision making.

Irresponsible children or their spouses – Assets can be protected from being squandered by children who are still immature and not financially responsible. Income can be made available but capital retained until children reach a specified age.

Income spreading – In some circumstances, income earned by the Trust can be spread among one or more of the beneficiaries to take advantage of their own lower tax rates, e.g. spouses, partners, children and grandchildren. Note that this is subject to the ‘minor beneficiary rule’, which provides that distributions to most minors (children under 16 years) must be taxed at the Trustee rate.

Cost-effective estate administration – The costs of winding up your estate may be substantially reduced or eliminated altogether.

How does a Trust work?

Assets are sold by the Settlor at market value into the Trust, which is controlled by the Trustees. The Trustees have an obligation to deal with this property for the benefit of the beneficiaries. These assets can be your home, bank investments, shares, chattels, or life insurance policies. These can be transferred all at once or progressively, as appropriate. Some assets might not be transferred until accrued tax losses are used up.

As gift duty has been abolished, assets can be transferred directly to a Trust by way of gift without gift duty applying. However, in some circumstances it will still be appropriate to sell assets and retain a debt back so that the person selling the assets retains some security in respect of the assets sold.

Income generated by the Trust and capital comprising the property owned by the Trust can be distributed to the beneficiaries at the discretion of the Trustees. Some Trusts provide that capital can only be paid out to discretionary beneficiaries during the lifetime of the Settlor(s). The Trustees also have the power to make distributions to individual beneficiaries to the exclusion of other beneficiaries. The beneficiaries under a Discretionary Trust have no power to require the Trustees to make any distribution to benefit them, as anything that they may receive is at the Trustee’s discretion.

Income retained in the Trust is taxable to the Trustees at a rate of 33%, while income distributed to beneficiaries is generally taxable at their personal rates. This sometimes enables Trusts to be used as a tax saving vehicle by distributing income to beneficiaries at the lower tax rates. For elderly beneficiaries, distributions of capital can be made, which if handled correctly, could avoid the imposition of a surcharge if re-introduced.

A Trust can be established in such a way that the Settlor can still enjoy the benefit of Trust assets. The Settlors can reserve the right to appoint and remove the Trustees (powers of appointment). The control of Trustee appointment desired by Settlors after the death of one of them can be specifically designed into the Trust Deed. However, where Settlors who are also Trustees and beneficiaries retain too much control, the courts may view the retention of power as property. This is often referred to as the Bundle or Package of Rights. Advice should be taken regarding how to diversify powers of appointment if this is a concern.

Trusts can operate for limited periods; many have a maximum life of 80 years, however, the Trusts Act 2019 allows this to be extended to 125 years, subject to the current powers and provisions within the Trust Deed. Most Trusts enable the Trustees to terminate the Trust at an earlier date if they so determine.

Different types of Discretionary Trusts

Mirror Trusts

These comprise of two separate Trusts. One is created by a husband or partner for the benefit of his wife or partner and children and any others as discretionary beneficiaries. The other is created by the wife or partner for the benefit of her husband or partner and children and others as discretionary beneficiaries. The husband and wife, or partners, transfer their property respectively into the Trust in which they are not a beneficiary. This results in the property being owned in equal shares by the two Trusts, the income and capital of which can then be distributed to the husband / partner and/or children, or to the wife / partner and/or children, respectively.

This type of Trust was used extensively when Death Duty was in place and is now less frequently used due to the fact that, upon the death of one spouse, the survivor loses access to capital and income of assets in the Trust established by the survivor. This style of Trust can be problematic when one spouse or partner dies and should be used with caution.

Sole Settled Trusts

A Settlor can create a Trust for the benefit of a range of beneficiaries including themselves. In this situation, there is an independent Trustee(s) and the beneficiaries usually comprise a wide class of persons and/or organisations.

Joint Settled Trusts

Joint Settlors, such as husband and wife or de facto / civil union partners, can create a Trust in which they are Trustees jointly with an independent Trustee. These Trusts best suit people in stable committed relationships of some duration.

Parallel Trusts

Two Trusts are created, one by each partner / spouse in the same form as Joint Settled Trusts with the right to appoint and remove Trustees being given exclusively to one partner / spouse in one of the Trusts. The beneficiaries are the same in each of the Trusts and one or both partners / spouses are Trustees. This format is particularly suitable for consideration where there are blended families or a desire to keep separation of assets transferred in by each partner / spouse.

Memorandum of Wishes

A Settlor can provide a signed letter or note to Trustees (to be used in the event of their death) indicating how the Trustees should manage assets, e.g. for the benefit of infant beneficiaries. Such letters are persuasive, but need not be adhered to by the Trustees.

Relationship of Will to Trust

In your Will, it may be appropriate to leave personal effects, chattels and cars to your spouse / partner and the rest of your personal estate directly to the Trust. This avoids the need for the survivor to subsequently gift into the Trust the assets received as a legacy from the deceased. The same benefit is derived from assigning life insurance policies to the Trust; upon the death of the Life Assured, the insurance monies go directly to the Trust. Any debt owed to you by the Trust should be forgiven in the Will.

Trustee’s liability

A Trustee’s role is a serious one. People approached to be an independent Trustee should give consideration to their personal liability and seek advice. Careful provision should be made to ensure that the Trustee’s liability to third parties is limited to the assets of the Trust. For example, if the Trust borrows money from a bank, a clause can be inserted in the bank’s mortgage, recording the fact that the Independent Trustee’s liability is limited to the assets of the Trust. Provided regular meetings of the Trustees are held, e.g. once every 6 or 12 months and appropriate decisions and resolutions are made, all matters affecting the Trust are easily monitored and there should be no major concerns regarding liability.

Advice on formation

Significant legal issues are involved in the formation of a Trust and transfer of assets into it. There is a need to harmonise your property ownership mode, your Wills, the Memorandum of Wishes, and the Trust set up; accordingly, it is vital to take advice from a practitioner experienced in this area of work.

To achieve your asset protection goals, it can also be necessary or desirable to enter into a Relationship Property Agreement to contract out of the Property (Relationships) Act 1976. This allows certainty and clarity regarding the ownership of assets transferred to a Trust and to what extent, if any, these comprise relationship property.

Our ‘Your Guide to Trusts’ not enough?

The better you understand your business and your financials, the easier it will be to make more money and ultimately achieve your goals. We have developed comprehensive resources to enable business owners to fully understand and interpret their numbers. Need more help? Join our free webinars on financial awareness coaching or talk to us about personalised financial awareness coaching. Contact Samantha for a call, zoom or meet on 06 871 0793.

Related Links:

7 Ways to Save on Accounting Fees

Feeling out of the loop? Click here to subscribe to the IRD to stay up to date.